Get the free illinois cms bid form

Show details

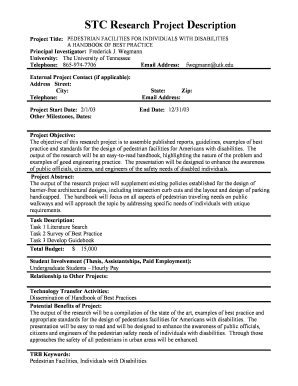

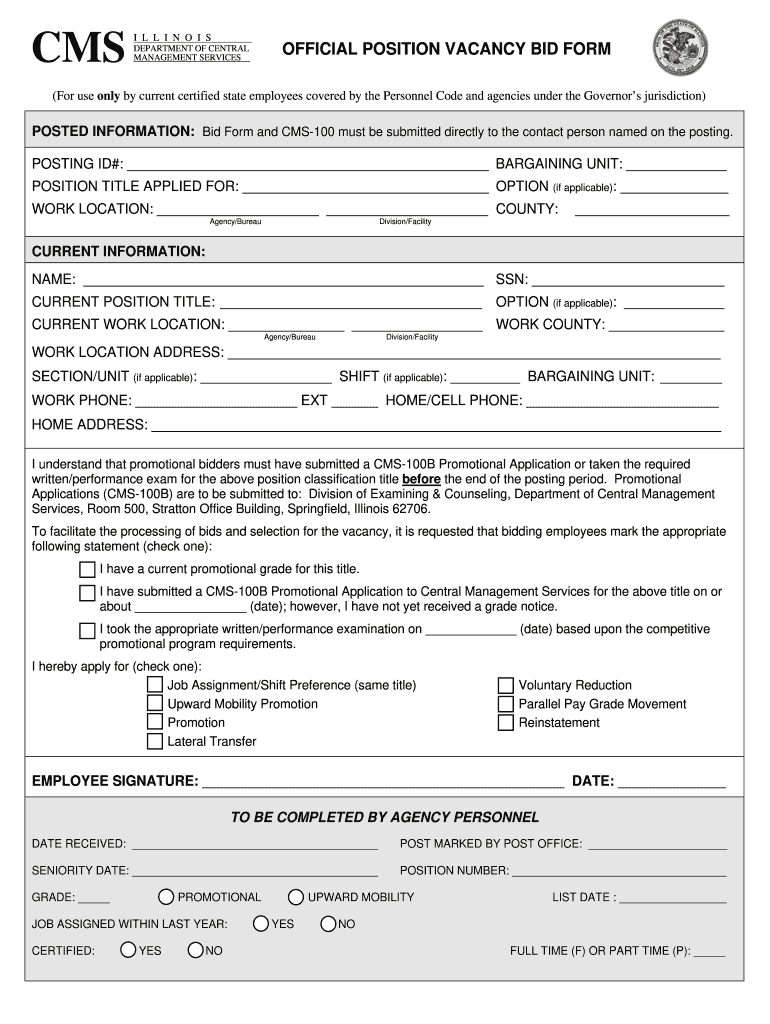

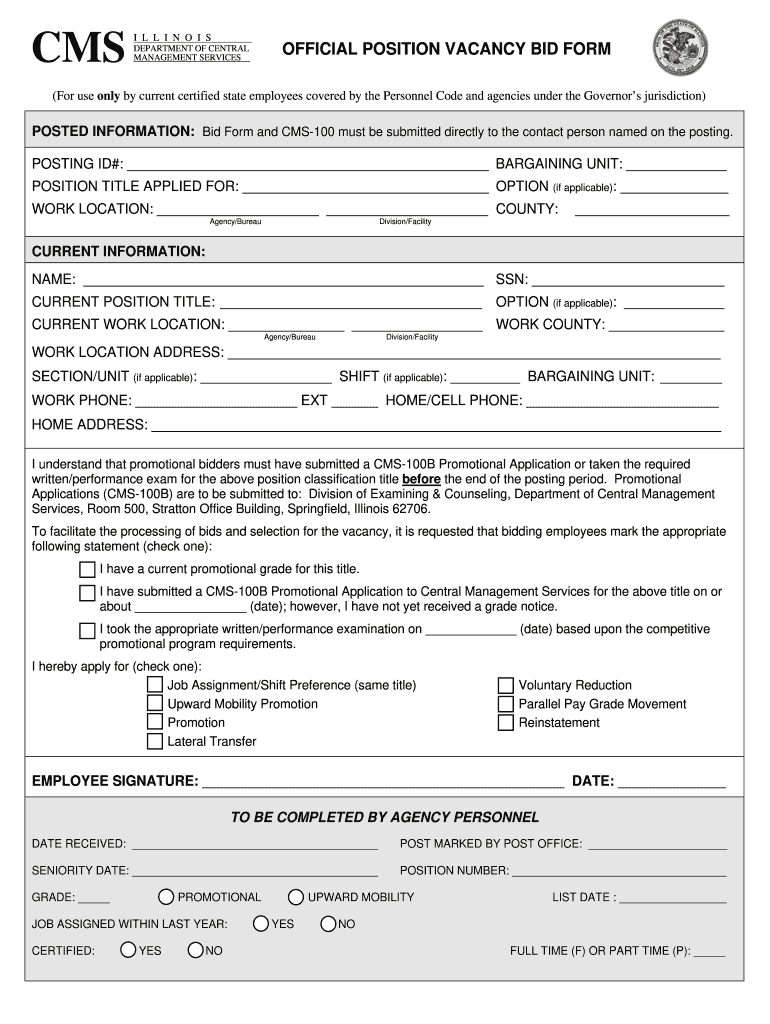

CMS I L L I N O I S DEPARTMENT OF CENTRAL MANAGEMENT SERVICES OFFICIAL POSITION VACANCY BID FORM For use only by current certified state employees covered by the Personnel Code and agencies under the Governor s jurisdiction POSTED INFORMATION Bid Form and CMS-100 must be submitted directly to the contact person named on the posting. POSTING ID BARGAINING UNIT POSITION TITLE APPLIED FOR OPTION if applicable WORK LOCATION COUNTY Agency/Bureau Division/Facility CURRENT INFORMATION NAME SSN...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign bid form il

Edit your state of illinois bid form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois position vacancy bid form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit illinois cms official position bid online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit illinois position bid form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out il bid vacancy form

How to fill out IL CMS Official Position Vacancy Bid Form

01

Obtain the IL CMS Official Position Vacancy Bid Form from the official website or your HR representative.

02

Fill out the personal information section, including your name, contact information, and eligibility status.

03

Provide details about the position you are applying for, including the job title and posting number.

04

List your relevant experience and qualifications that align with the job requirements.

05

Attach any supporting documents, such as your resume and cover letter, if needed.

06

Review the form for completeness and accuracy before submitting.

07

Submit the completed form by the specified deadline to the appropriate HR contact or online portal.

Who needs IL CMS Official Position Vacancy Bid Form?

01

Job applicants seeking positions within Illinois state government agencies.

02

Individuals interested in applying for specific roles as posted on the IL CMS job vacancy announcements.

Video instructions and help with filling out and completing illinois cms bid form

Instructions and Help about form illinois position

Fill

cms 100 bid form

: Try Risk Free

People Also Ask about illinois bid form

Do I claim 0 or 1 on my w4?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

When was 2023 w4 released?

A draft of the 2023 Form W-4 was released Dec. 7 by the Internal Revenue Service. Changes in the draft primarily removed references to the IRS's tax withholding estimator at several points in the form and instructions. Amounts used in the Step 2(b) and Step 4(b) worksheets were also updated.

Does Illinois have a state W-4 form?

You must submit Form IL-W-4 when Illinois Income Tax is required to be withheld from compensation that you receive as an employee. You may file a new Form IL-W-4 any time your withholding allowances increase. If the number of your claimed allowances decreases, you must file a new Form IL-W-4 within 10 days.

Is there a new W-4 form for 2023?

The new W-4 form for 2023 is now available. Unlike the big W-4 form shakeup of 2020, there aren't significant changes to the new form. But that doesn't mean you shouldn't familiarize yourself with it. You may not file Form W-4 with the IRS, but your payroll depends on it.

How do I fill out a W-4 form in Illinois?

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. Step 2: Indicate Multiple Jobs or a Working Spouse. Step 3: Add Dependents. Step 4: Add Other Adjustments. Step 5: Sign and Date Form W-4.

Was there a change in federal tax withholding 2023?

Broadly speaking, the 2023 tax brackets have increased by about 7% for all filing statuses. This is significantly higher than the roughly 3% and 1% increases enacted for 2022 and 2021, respectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete illinois cms vacancy bid form online?

pdfFiller has made filling out and eSigning illinois official vacancy form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an eSignature for the illinois position bid in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your cms 100 state form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit illinois vacancy bid form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like il position bid form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is IL CMS Official Position Vacancy Bid Form?

The IL CMS Official Position Vacancy Bid Form is a document used by state agencies in Illinois to request bids from applicants for official position vacancies.

Who is required to file IL CMS Official Position Vacancy Bid Form?

State agencies in Illinois that have official position vacancies are required to file the IL CMS Official Position Vacancy Bid Form.

How to fill out IL CMS Official Position Vacancy Bid Form?

To fill out the IL CMS Official Position Vacancy Bid Form, state agencies must provide relevant details about the position, including job title, responsibilities, qualifications, and application instructions.

What is the purpose of IL CMS Official Position Vacancy Bid Form?

The purpose of the IL CMS Official Position Vacancy Bid Form is to facilitate the recruitment process by formally notifying potential candidates of job openings and providing a structured way for agencies to collect bids from applicants.

What information must be reported on IL CMS Official Position Vacancy Bid Form?

The information that must be reported includes the job title, a description of job duties, required qualifications, application deadline, and instructions on how to apply.

Fill out your IL CMS Official Position Vacancy Bid Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cms Bid Form is not the form you're looking for?Search for another form here.

Keywords relevant to illinois cms bid form pdf

Related to il vacancy bid form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.